A global leader –

the importance of the

London insurance market

The UK leads the world when it comes to insurance broking. The London insurance market is larger than the Bermuda, Singapore and Switzerland markets combined.11 Its pre-eminence does not lie solely in revenue numbers, but also in its centuries-old mission to close the gap between economic risk and insured risk through constant innovation and entrepreneurship. Examples include natural catastrophe reinsurance, cyber risk, political violence and trade disruption.

It relies on talent, diversity, social mobility and the ability to trade efficiently within a regulated environment that is fair and proportionate. It has adjusted to the challenges of Brexit, but it has been costly as the volume of European based risks being placed in the UK has declined.12 There is an opportunity for Government to reset its relationship with the EU and reinstate some of the freedoms that existed prior to January 2020.

UK broking in the London Insurance Market11

of risk premium placed into the London market and growing

people employed in highly skilled, well-paid jobs

contribution to the City’s GDP

of premiums from overseas

The UK is fantastic place to do business. I’m proud Howden is at the heart of local communities right across the land and I love, in particular, having our HQ in the City. London has got the highest concentration of insurance talent in the world. And this is where our company grew up – from three people and a dog to one of the world’s top ten brokers.

Our City base already gives us exceptional access to capital and talent to support our customers throughout the UK and in multiple continents.

Yet, for all its historic success, the London market remains a place of huge untapped potential. In a rapidly evolving geo-political landscape, insurance alone has the power to de-risk potentially trillions currently sitting untouched on company balance sheets. That’s money that can be channelled into everything from climate resilience to cyber solutions, from real estate to renewables. In other words, the City holds the key.

Our task is to keep innovating, keep pushing the boundaries and keep putting our clients first. If we do that London will remain a global leader, galvanise our economy and help make life better for billions.

Reaching communities

across the country

At the heart of the BIBA membership stand community insurance brokers, based in towns and cities across the length and breadth of the UK.

They understand the local issues and offer advice, often to the most vulnerable who need it most. They are interwoven with the local business community and advise on the insurance protection that enables businesses to take measured risk and grow. In a very real sense, local brokers are an enabler of Government’s wider mission to empower local communities as part of the growth agenda. Insurance brokers also provide highly-skilled jobs to young people in their communities and are agnostic about educational background. At the same time, they offer the chance to earn internationally recognised professional qualifications. In this way, they promote social mobility and break down the barriers to career opportunity.

AXA is committed to providing local service to local brokers which is why we have been opening new offices and investing in our branch network across the UK. We place immense value on the relationships which we have built over many decades and the mutual customers we serve. Our broker partners are well-placed to understand the risks that are specific to their communities and provide advice on the right levels of protection to ensure good customer outcomes.

Regional spotlight – Northern Ireland

Insurance brokers have a long and proud tradition of serving local communities in Northern Ireland and employ thousands of people in varied roles. However, they are facing a serious lack of insurer choice, when it comes to home insurance and increasingly motor insurance. Of the insurers who underwrite risks in Northern Ireland, there are few who have a physical presence there, with the remainder being based in other parts of the UK. Location is important when it comes to understanding Northern Ireland’s specific and unique characteristics.

Home

In the home market, for example, Northern Ireland has older housing stock13, a prevalence of oil-fired heating14, a larger percentage of rural versus urban households than in other parts of the UK, a lack of commercially available flood data and an historic underinvestment in flood defences. All these factors give the advised sale added importance to make sure customers get the cover they need. Local consumers have a long tradition of turning to community-based brokers for this advice.

Motor

Motor insurance also has specific challenges there, which make a local broker’s advice so important. For example, there are many motorcycle users, a large number of rural roads, a higher percentage of young and novice drivers leading to higher deaths and serious injuries15, strains on supply chains post Brexit that make repairs longer, and serious delays in MOT certification. There is a lack of access to MyLicence and Navigate (formerly Motor Insurance Database) which restricts the level of information insurers and authorities have on driving history and insurance coverage.

Northern Ireland is a truly unique insurance market with its own particular challenges and opportunities. This is deeply understood by a strong broking sector rooted in our local communities, which has served local customers for generations. To continue to thrive, and for insurance brokers to be able to offer affordable choices to customers, more insurer capacity is needed, especially in the home sector. We are committed to working with all stakeholders to make Northern Ireland attractive to insurers and to the mission of giving quality advice to those customers who need it most.

Claims

The cost of claims in Northern Ireland is higher than across the rest of the UK and the lack of regulation of claims management companies can introduce extra cost and friction to the claims process.

The cost of awarded damages is significantly higher than in other parts of the UK, which is why BIBA supports the call to introduce a claims portal for lower value road traffic accident claims as in England and Wales. Such a portal would improve access to justice and offer plaintiffs earlier settlement of their claims and any awards of damages. It would also help to address some of the behaviours by plaintiff solicitors which delay litigation and increase defendants’ legal costs which put further inflationary pressure on the cost of motor insurance and other liability policies.

Capacity

There is a need to maintain and grow the number of insurers who are active in Northern Ireland to support the broking channel in its aim to offer choice alongside advice to consumers.

While Northern Ireland services excel in many areas, claims reinstatement costs can be reportedly higher. This, plus the differences in legal frameworks and the role of loss assessors being considerably more prominent, to ensure the best outcomes for customers, we fully support BIBA's call for the mandatory registration of all professionals involved in the claims process, not just Loss Adjusting firms.

Skills for the future

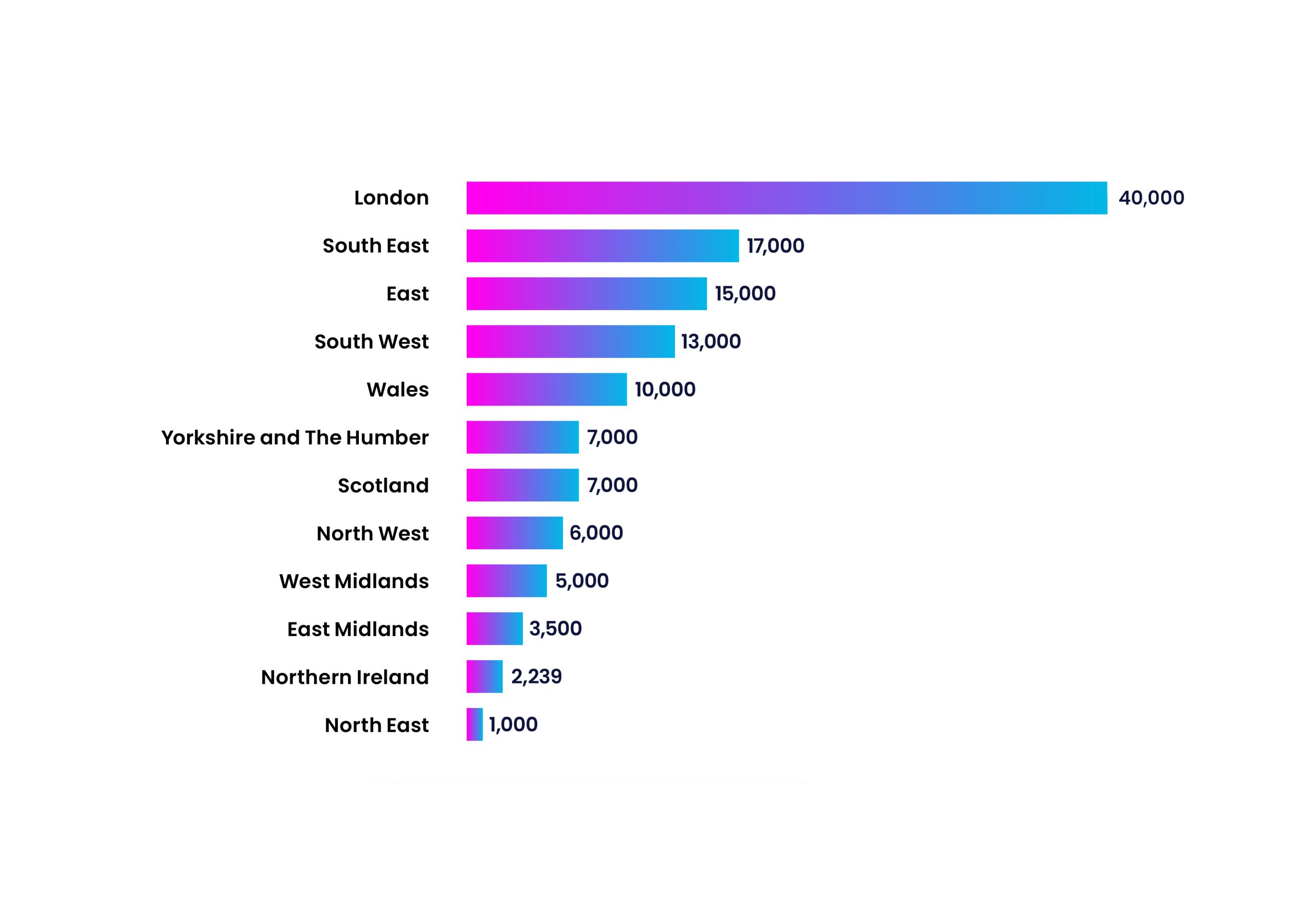

Insurance broking offers an exciting career choice for participants: it employs around 126,000 people across the UK and this number has grown by around 14% in Great Britain since 2015.

Just over half (55%) of the employment opportunities are outside London and the South East and are spread UK wide, so contributing to regional opportunities and prosperity.

Insurance agents and brokers number of employees

Modern industrial strategy – supporting jobs

In its October 2024 paper on a modern industrial strategy, the Government has recognised financial services as one of eight growth-driving sectors. Our sector offers opportunities at varying entry points from school leavers to apprenticeships and graduate roles. As well as needing those with professional insurance qualifications, the sector employs people in roles such as finance, marketing, risk and audit.

Many people view insurance as a complex product and need the help of a professional insurance broker to help them buy suitable protection: trained and skilled staff are essential for this. However, there are several issues that impact this positive picture.

Many insurance broking firms are SMEs, and evidence shows that attracting talent by offering training opportunities can be harder for smaller businesses. The extra administrative load and cost of apprenticeships is heavier on SMEs than larger businesses that can more easily absorb these factors.

Covéa are an intermediated business that focuses on customer excellence. In order to deliver this both the Covéa team and the brokers need excellent people with the right skills. We are very supportive of the growth and development of brokers within the regions and fully support BIBA in calling for more support for smaller firms to offer opportunities and skills training.

Unique and diverse need for skills

Insurance broking is a service industry that offers many different product and service propositions to its client base – ranging from non-advised sales of consumer-based products with no claims support service, to advised-sales of more complex products with a full claims support service to businesses of all sizes. Based on their business models, each insurance broking business has a unique and diverse need for technical knowledge and soft skills based on these factors that is not always offered by existing apprenticeship standards.

ONS data for employment by age and industry for 202216 shows that of those working in insurance and auxiliary activities, almost 40% are aged 45 or older. To ensure there are sufficient skilled workers to serve our sector, we need to upskill and reskill existing workers and tap into the resource of older people that might move into the insurance broking sector.

The landscape for insurance is evolving, adding to the need for new skills. It will be impacted by future technology capabilities (including AI) and through evolving risks, such as cyber, intellectual property, climate and digital assets that will require product and underwriting innovation.

11 City of London Corporation

12 The volume of premium placed into the London company market has dropped from £4.9bn in 2018 to £1.8bn in 2023. Source IUA.

13 See https://files.bregroup.com/bretrust/The-Housing-Stock-of-the-United-Kingdom_Report_BRE-Trust.pdf

14 According to the 2021 Census Data, 49.5% of homes in Northern Ireland used oil as their only central heating as opposed to 5.1% in Scotland and 3.5% in England and Wales (see https://researchbriefings.files.parliament.uk/documents/CBP-9838/CBP-9838.pdf)

15 Northern Ireland Road Safety Strategy to 2030 – Annual Statistical Report 2024

16 ONS Employment by detailed occupation and industry, by sex, age group and country, 2020 to 2023