We are encouraged by the FCA’s consultation on how it could simplify and streamline its rulebook and rely on the Consumer Duty to achieve the regulator’s objective for appropriate consumer protection. In our response to the consultation BIBA highlighted at least 11 ICOBS rules that could be removed entirely and further rules which could be reformed or enhanced. We believe this approach would help firms meet their regulatory obligations in a way that fits their operating model whilst maintaining protection for consumers. Simplifying the Retail Conduct Rules will attract investment into the UK as investors will be more confident in their understanding and meeting regulatory requirements without the burden that the existing, prescriptive regulations create. Economic growth and attracting international businesses to the UK is vital. When investors are faced with less complicated and burdensome regulations from other overseas markets, they may be less likely to invest in the UK.

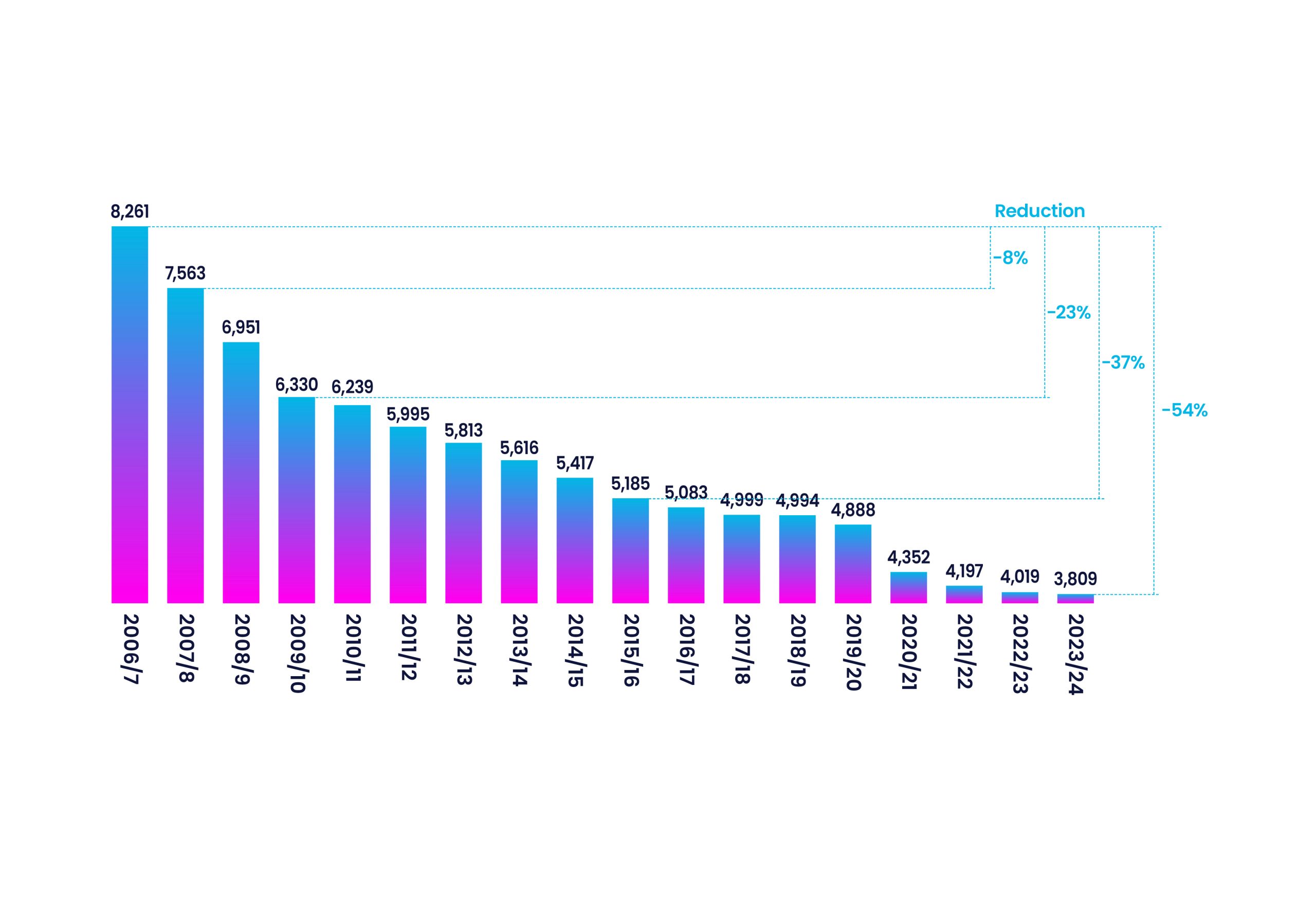

The impact of the UK’s current regulatory handbook can be seen in the declining number of general insurance intermediaries. Many businesses exiting the market cite regulatory burden as the primary reason for their exit.

Number of UK General Insurance Intermediaries

Recently the FCA has introduced examples of good and poor practice in their thematic review findings. However, examples for the range of different sized firms across the sector would be welcome.

The way firms are interpreting the current product value and fair value assessment requirements that apply to insurers and intermediaries involves unnecessary duplication, is resource heavy and embodies an ‘unintended’ burden on our members.

A typical insurance broker that might distribute 20 products from 50 insurers is expected to complete 1,000 fair value assessments. This equates to thousands of hours spent by insurance brokers. Despite the positive intentions that the regulator began with, the execution has created an unreasonable burden affecting broker productivity.

The FCA’s five-year strategy, published in March, demonstrates the regulator’s commitment to further developing its outcomes-based approach, with a focus on reviewing and streamlining the handbook.

CP25/12 is also the first consultation paper to start the ball rolling on streamlining the handbook with proposals that include:

- Amending the category of customers that will fall outside the scope of the CD, PROD and ICOBS rules

- Reducing the frequency of product value/fair value assessments and giving firms flexibility to determine the frequency of reviews based on the risk of the product, which may result in potential consumer harm

- Introducing a sole lead manufacturer that will be responsible for meeting PROD 4.2 requirements

- Amending the rules and guidance in SYSC 28.2 and 28.4 regarding minimum knowledge requirements and record keeping

- Disapplying ICOBS and PROD rules for overseas business

- Removing some product specific rules, e.g., ICOBS 6A.1: Guaranteed asset protection

Chart source: FCA Data Bulletins