- Introduction from BIBA’s Chair, Jonathan Evans, which sets out the opportunities and challenges the insurance broker market will face in 2025 and why brokers are at the heart of helping people and businesses.

- A Message from BIBA’s Chief Executive, Graeme Trudgill, sets out his intent for BIBA to work in partnership across the insurance market and how insurance brokers add value at personal, local, national and global level. He describes local the contribution insurance brokers make to growth and how this Manifesto showcases the very best the sector has to offer.

- The City Minister highlights how vital insurance is to their industrial strategy and how insurance brokers can help businesses to grow. She also expresses a belief in effective and proportionate regulation to deliver the Government’s mission for inclusive growth and promoting the international competitiveness of UK financial services.

- The insurance broking sector in numbers – some that may surprise you! Along with all the ways that brokers can add value to a customer’s insurance arrangements.

View from the BIBA’s Chair

With the Government’s new modern industrial strategy, an active legislative agenda and investment planned across the economy, 2025 offers an opportunity to underline the importance of insurance brokers at the heart of its national missions.

Alongside opportunity also sits challenge. The increasing frequency of cyber-attacks, new methods and materials for buildings, rising flood propensity, and the deployment of new technologies and innovations such as AI, all mean risk management and advice are more valuable than ever. Yet we are facing a rising protection gap, consolidation in the broker market and some areas of constrained insurance capacity.

Ultimately, if we want to overcome these challenges, and support opportunities to grow and secure the economy, we need to work in partnership with Government, the regulators and other stakeholders to deliver good outcomes for all.

BIBA and our members are committed to doing all we can to fulfil the needs and ambitions of our customers.

I am looking forward to the work ahead in 2025.

Jonathan Evans

BIBA Chair

Message from

BIBA's Chief Executive

This 2025 Manifesto sets out my intent for BIBA to work in partnership with decision makers and market participants.

In addition, we will continue to work with Government to support the UK’s economic growth. Our approach of allyship inside and around our sector will aim to help insurance brokers deliver great insurance solutions and value to consumers and businesses, and help markets work well.

The insurance broking sector delivers value on multiple levels. It provides many thousands of skilled jobs across the country, enables social mobility and contributes 1% of GDP through revenues from advising on and placing risk. Collectively, our sector manages over £100bn in premiums that derive from the UK and around the world with London remaining the pre-eminent marketplace.

Beyond size, our sector provides value in the advice it gives, often at the local level, building better societal and economic resilience within communities. Brokers work hard for their customers, providing confidence for businesses and increasing resilience. They understand customers’ unique needs and deliver value by helping them to identify and mitigate risk and achieve better outcomes at the point of claim. Insurance is complex and works best when it comes with advice. Our case studies illustrate the type of value our members add day in, day out.

This Manifesto calls on Government to work with us to close the protection gap in key areas such as flood. It asks our insurer partners to work with us to address emerging risks such as cyber. It calls on the regulator to work with us to simplify the insurance broking rulebook making regulation more proportionate enabling the sector to remain healthy.

For our part we will continue to invest in members, doing our best to help them thrive and offer support to their customers. We will also continue to encourage young people to consider the many opportunities that a career in broking can bring.

I hope you enjoy reading this year’s Manifesto and I look forward to working with you to deliver on our commitments.

Graeme Trudgill FCII

BIBA CEO

Chartered Insurance Practitioner

Comment from the Insurance Minister

![]()

The financial services sector, including insurance broking, plays a vital role in driving growth across the UK economy. This is why the government has named financial services as one of our eight priority sectors within our industrial strategy.

Businesses of all sizes need to be able to access the right insurance, at the right time, to support their financial resilience and their ability to grow. Consumers need to be able to access the cover they need for their homes, possessions, and important life events. Just last year, brokers arranged over £105 billion of insurance. The crucial work of BIBA, and insurance brokers across the country, is vital to delivering accessible, affordable and appropriate insurance products for all.

I believe effective and proportionate regulation is key to delivering the Government’s mission to drive inclusive growth and promote the international competitiveness of UK financial services.

I look forward to working with BIBA, its members, and the entire broking sector, to support a thriving and competitive insurance market across the UK that delivers for both businesses and consumers.”

Emma Reynolds MP

Economic Secretary to the Treasury

General insurance broking sector statistics

Revenue1

Total written through brokers across ALL lines

Written through brokers in commercial lines

Brokers as part of the economy

Insurance premiums arranged by brokers contribute approximately 1% of the UK’s GDP4

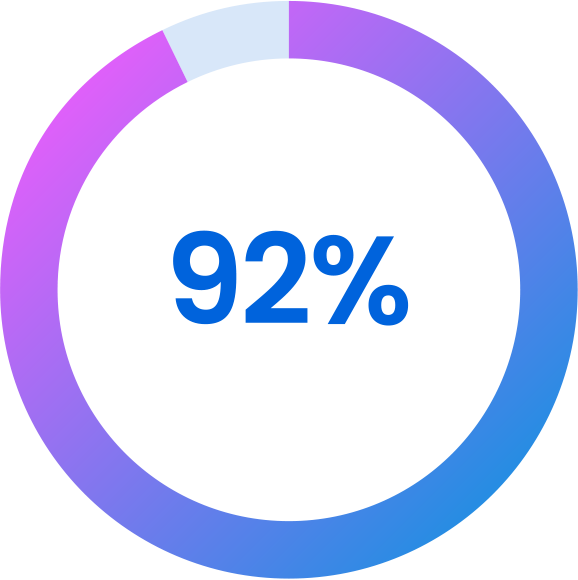

of medium-sized businesses (50-249 employees) say insurance has enabled them to grow their business

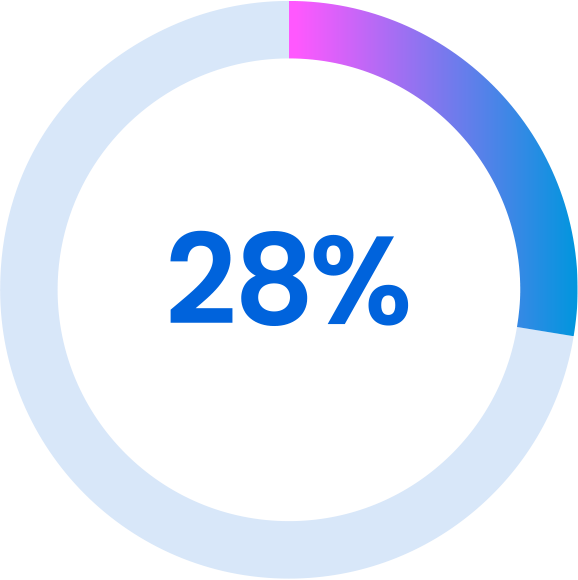

of sole traders do not

feel confident in assessing

their insurance needs

(16% across all SMEs)

Why use a broker?

Insurance brokers have access to a wide choice of products from the majority of insurance markets and can search the market for you

Added security for eligible classes of insurance provided by the Financial Services Compensation Scheme

They can help you to assess your risk management, health and safety issues, fire prevention and premises security

They clearly state the costs of the policy and any fees they may charge

They have their own professional indemnity insurance protection providing customer confidence

They give customers fair treatment, with the additional assurance of the Financial Ombudsman Service

They can give advice on suitable insurance protection without any upfront payment

They can represent you in claims settlements

They provide clear information and documents

They can negotiate the most appropriate terms and competitive premiums

They provide access to cover for unusual or challenging risks and situations

They are authorised and regulated by the Financial Conduct Authority

1 FCA RMAR Section B (P&L) – all firms on the FCA register at 31 December 2023 reporting a full year of revenue earned from non-investment insurance activities

2 Nomis BRES 2023, NISRA 2022 SIC66220 activities of insurance agents and brokers

3 ABI figures Nov 2023. Includes Lloyd’s, ABI, non-ABI members, ‘Home Foreign’, Marine, Aviation & Transport for ABI members only, and reinsurance. ‘Home foreign’ is insurance written in one country on property or risks located in another and figures include an estimate of Lloyd’s home foreign business.

4 UK GDP £2.27 trillion in 2023, source United Kingdom; Office for National Statistics (UK); 1948 to 2023

5 Insurance Premium Tax (IPT) commentary (July 2024) – GOV.UK

6 Opinium Research 2024